Tellus Review: A High-Yield Cash Management Account That Actually Makes Saving Worth It

Everyone has financial goals that they’re trying to reach, but when it comes to growing your net worth to achieve major financial milestones, traditional savings accounts from brick and mortar banks just don’t do the trick anymore.

Yeah, back in the day, traditional savings accounts were high-interest — I’m talking APYs that were as high as 5% up until the 1980s — but unfortunately, that’s just not the case anymore. Today, most savings accounts offer interest rates that haven’t kept up with inflation and do almost nothing to help you earn money on your money. You’ll be lucky to earn a few dollars a year, max.

So what are you supposed to do? Investing offers a higher return, but typically also comes with greater risk. Appropriately balancing your investing funds with your saving funds, ensures that you always have, at minimum, an emergency fund cushion. You always want to have money stashed away to help you meet any short-term cash crunch needs. And if you’re planning for a specific expense that you know is coming up — like saving for a new car, family vacation or a down payment on a house — you might be more comfortable saving money towards them, rather than investing money in the stock market and riding out the ups and downs that often come with it.

That’s the space Tellus is hoping to fill in the market by offering a high-yield cash management account backed by real-estate investments with a 3% and up annual percentage yield (APY) that compounds daily. That’s not all Tellus does, it also offers other financial services to help you build wealth. In this post, I’ll do a deep dive into what the app is all about.

Tellus Boost is the app’s cash management account. What is a cash management account exactly? It’s an alternative to traditional checking or savings accounts. They’re offered by financial institutions that are not banks or credit unions, and typically combine checking, savings, and sometimes even investing account services and features. Many are known to offer competitive interest rates on deposited cash.

Tellus Boost provides a daily compounding interest of 3% on account balances, which is unheard of for any checking account, let alone traditional savings accounts.

Most checking accounts don’t offer interest on deposited cash, and most savings accounts have very low APYs that only end up earning you a few cents on the dollar a year. According to the FDIC, the current national average APY for a savings account is 0.04%. The daily compounding 3% APY that the Tellus Boost account offers is 50 times that. That daily compounding interest really works in your favor to grow your savings quickly — you earn interest on your interest — and you can see it having an impact every single day.

There are also opportunities to boost that APY up to 6% daily by doing simple things like logging into your account daily, completing fun quizzes and referring friends.

There are two kinds of boosts — daily boosts and extended boosts — and only a single boost can be applied at a time. Daily logins and quizzes (which help educate users on personal finance topics), fall into the daily boost category and only last for a day.

Extended boosts, which last longer than a day, are earned by completing special activities like friend referrals to Tellus. This can earn you a few different rewards, like a 1% increase in your daily APY for 30 days, 2x the 3% APY for a week or cash rewards. Right now, Tellus is offering +1% APY extended boost that lasts for a month for referring a friend. Simple math — that brings your Tellus Boost APY up to 4%, which will compound and get paid out daily. Keep an eye out for other special offers like this one since they come and go. They can have a significant impact on your savings.

Tellus really emphasizes its users’ ability to earn interest. Users get real-time updates to the second on account activity and every day they log in to the app they will see how much money in interest they’ve earned that day.

To open and maintain a Tellus Boost account, you have to have a minimum balance of $200. Other than that there are no other requirements and there are no fees.

Tellus Boost is the app’s cash management account. What is a cash management account exactly? It’s an alternative to traditional checking or savings accounts. They’re offered by financial institutions that are not banks or credit unions, and typically combine checking, savings, and sometimes even investing account services and features. Many are known to offer competitive interest rates on deposited cash.

Tellus Boost provides a daily compounding interest of 3% on account balances, which is unheard of for any checking account, let alone traditional savings accounts.

Most checking accounts don’t offer interest on deposited cash, and most savings accounts have very low APYs that only end up earning you a few cents on the dollar a year. According to the FDIC, the current national average APY for a savings account is 0.04%. The daily compounding 3% APY that the Tellus Boost account offers is 50 times that. That daily compounding interest really works in your favor to grow your savings quickly — you earn interest on your interest — and you can see it having an impact every single day.

There are also opportunities to boost that APY up to 6% daily by doing simple things like logging into your account daily, completing fun quizzes and referring friends.

There are two kinds of boosts — daily boosts and extended boosts — and only a single boost can be applied at a time. Daily logins and quizzes (which help educate users on personal finance topics), fall into the daily boost category and only last for a day.

Extended boosts, which last longer than a day, are earned by completing special activities like friend referrals to Tellus. This can earn you a few different rewards, like a 1% increase in your daily APY for 30 days, 2x the 3% APY for a week or cash rewards. Right now, Tellus is offering +1% APY extended boost that lasts for a month for referring a friend. Simple math — that brings your Tellus Boost APY up to 4%, which will compound and get paid out daily. Keep an eye out for other special offers like this one since they come and go. They can have a significant impact on your savings.

Tellus really emphasizes its users’ ability to earn interest. Users get real-time updates to the second on account activity and every day they log in to the app they will see how much money in interest they’ve earned that day.

To open and maintain a Tellus Boost account, you have to have a minimum balance of $200. Other than that there are no other requirements and there are no fees.

So right now, you probably have a few questions running through your mind, like who determines the interest rates for savings accounts? And how is Tellus able to offer such high daily compounding interest then? Well, we have answers.

Interest rates for bank accounts, along with loans, credit cards and so on, are largely influenced by The Federal Reserve (the Fed) — the United States central banking system that’s basically in charge of maintaining the country’s economic and financial stability. It creates national financial policy to regulate banks, manages inflation and interest rates and maximizes employment. The Fed sets what’s called the federal funds rate — how much banks can charge each other to lend funds overnight. Financial institutions then use this as a benchmark to determine interest rates for things like savings accounts. So, if The Fed lowers the federal funds rate, banks and credit unions will likely fall in line and lower interest rates on savings accounts so that they can protect their profits.

The federal funds rate can change multiple times in a year as the economy shifts, and that’s why in 2020 during the height of the pandemic, The Fed issued two emergency cuts to the federal funds rate, bringing it down to a record low of 0 to 0.25%. Even with the economy starting to bounce back, they’ve been slow when it comes to raising interest rates. But, like I said, interest rates for traditional savings accounts have been pretty low for years now. Honestly, you would be lucky to find one with an APY of 1%.

So how is Tellus able to offer 3% daily compounding interest with opportunities to bump that up to 6%? Tellus earns revenue from investments it makes in residential properties via secured loans and account holders get to reap the benefits of that with a high daily APY.

So right now, you probably have a few questions running through your mind, like who determines the interest rates for savings accounts? And how is Tellus able to offer such high daily compounding interest then? Well, we have answers.

Interest rates for bank accounts, along with loans, credit cards and so on, are largely influenced by The Federal Reserve (the Fed) — the United States central banking system that’s basically in charge of maintaining the country’s economic and financial stability. It creates national financial policy to regulate banks, manages inflation and interest rates and maximizes employment. The Fed sets what’s called the federal funds rate — how much banks can charge each other to lend funds overnight. Financial institutions then use this as a benchmark to determine interest rates for things like savings accounts. So, if The Fed lowers the federal funds rate, banks and credit unions will likely fall in line and lower interest rates on savings accounts so that they can protect their profits.

The federal funds rate can change multiple times in a year as the economy shifts, and that’s why in 2020 during the height of the pandemic, The Fed issued two emergency cuts to the federal funds rate, bringing it down to a record low of 0 to 0.25%. Even with the economy starting to bounce back, they’ve been slow when it comes to raising interest rates. But, like I said, interest rates for traditional savings accounts have been pretty low for years now. Honestly, you would be lucky to find one with an APY of 1%.

So how is Tellus able to offer 3% daily compounding interest with opportunities to bump that up to 6%? Tellus earns revenue from investments it makes in residential properties via secured loans and account holders get to reap the benefits of that with a high daily APY.

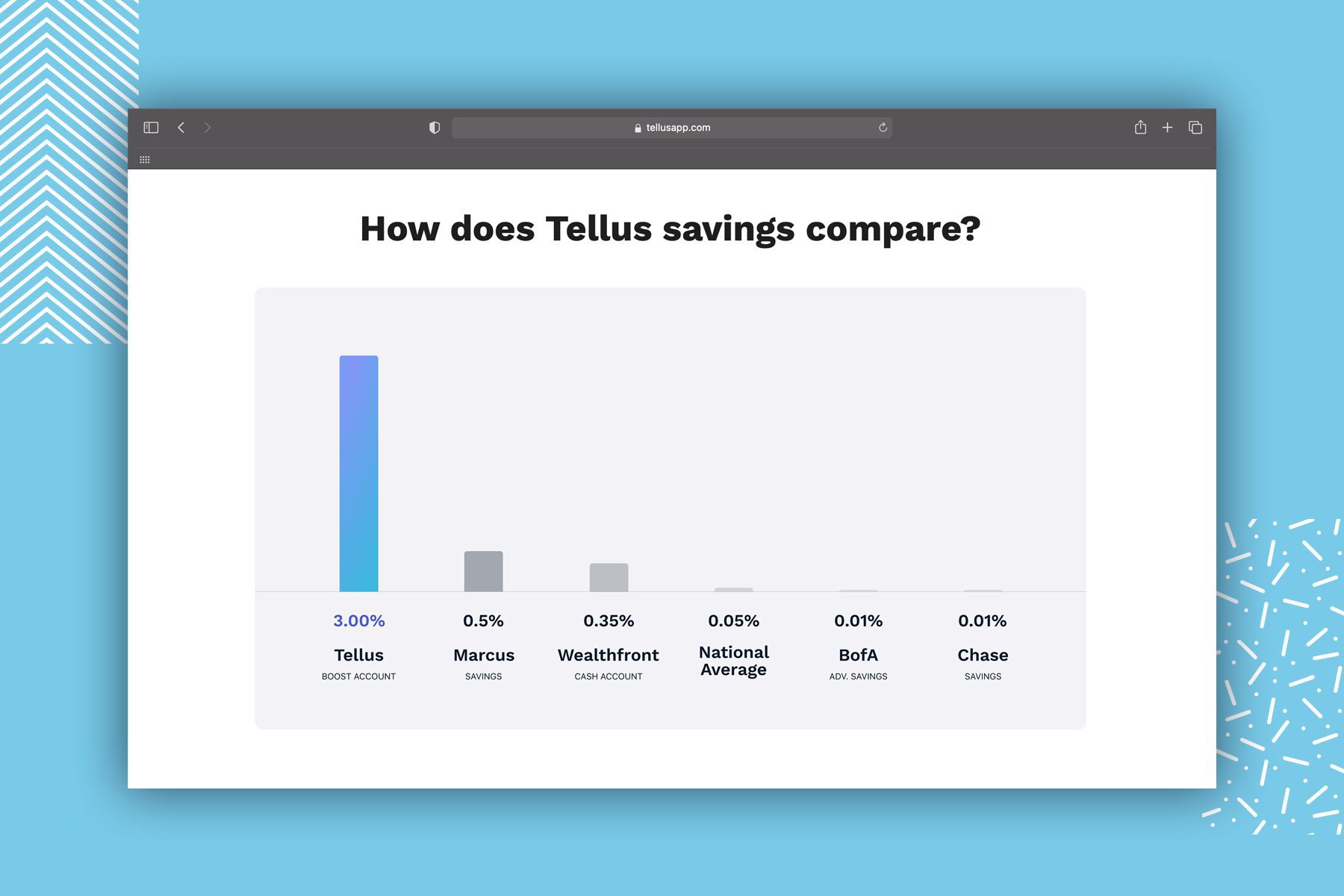

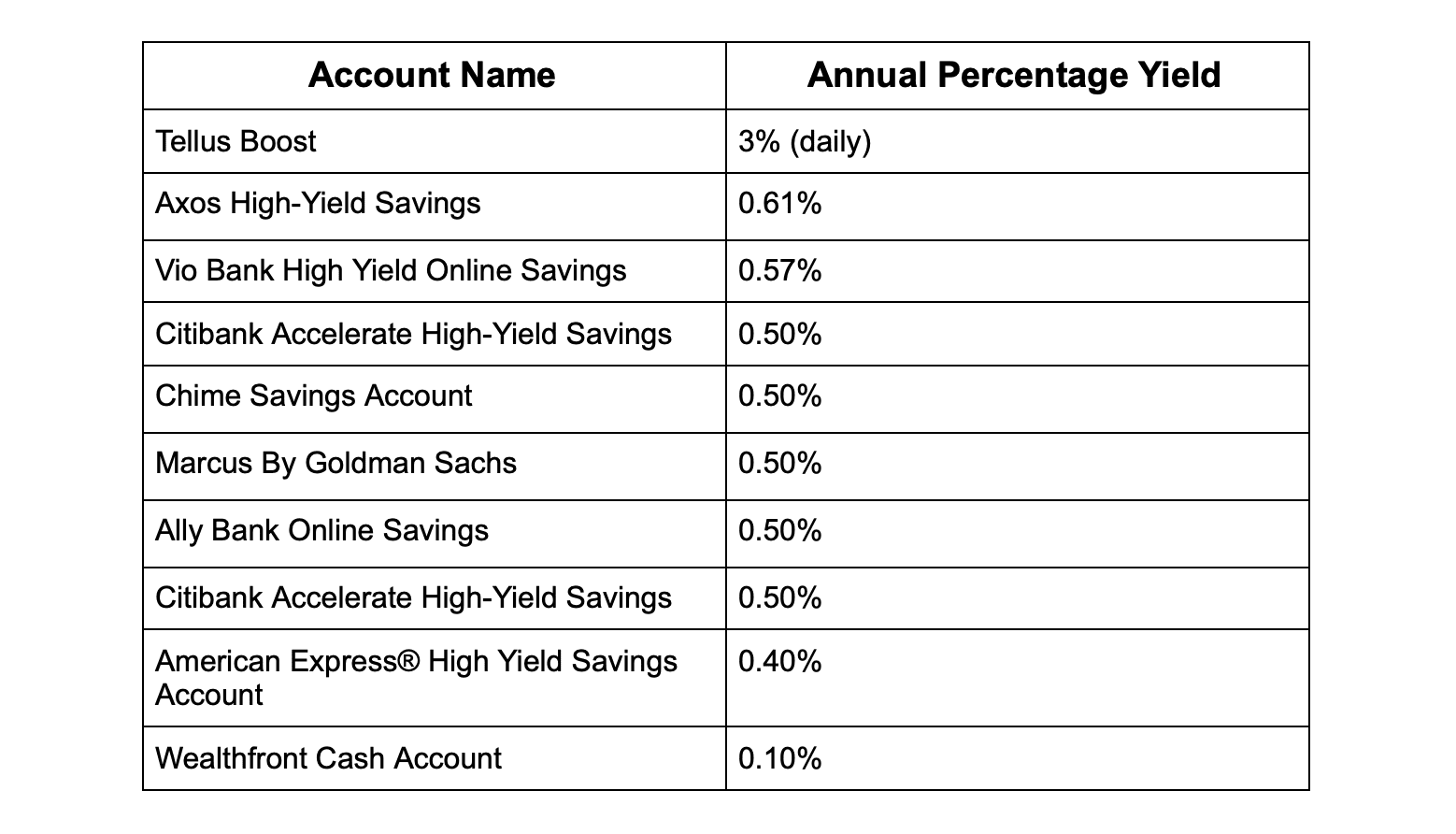

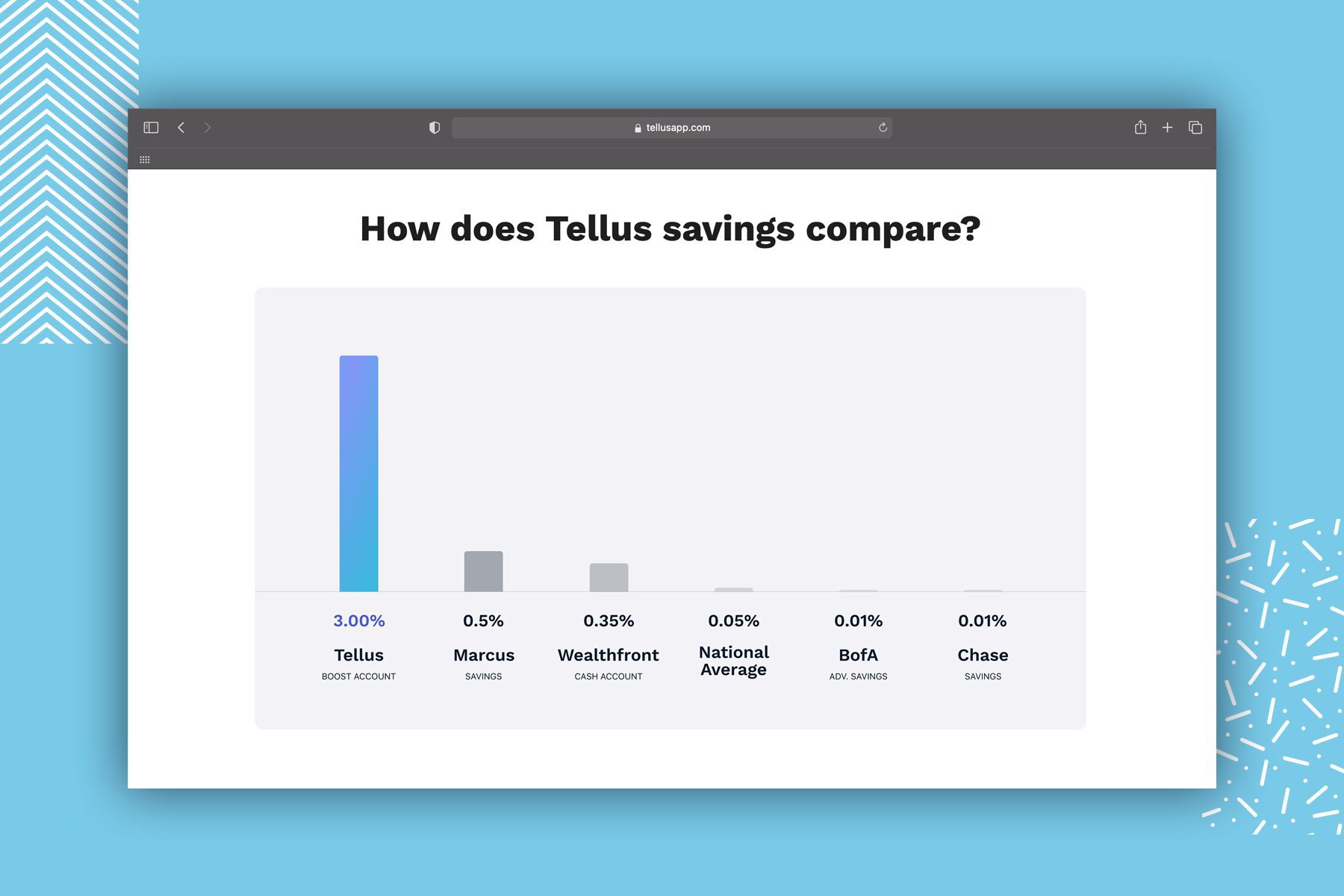

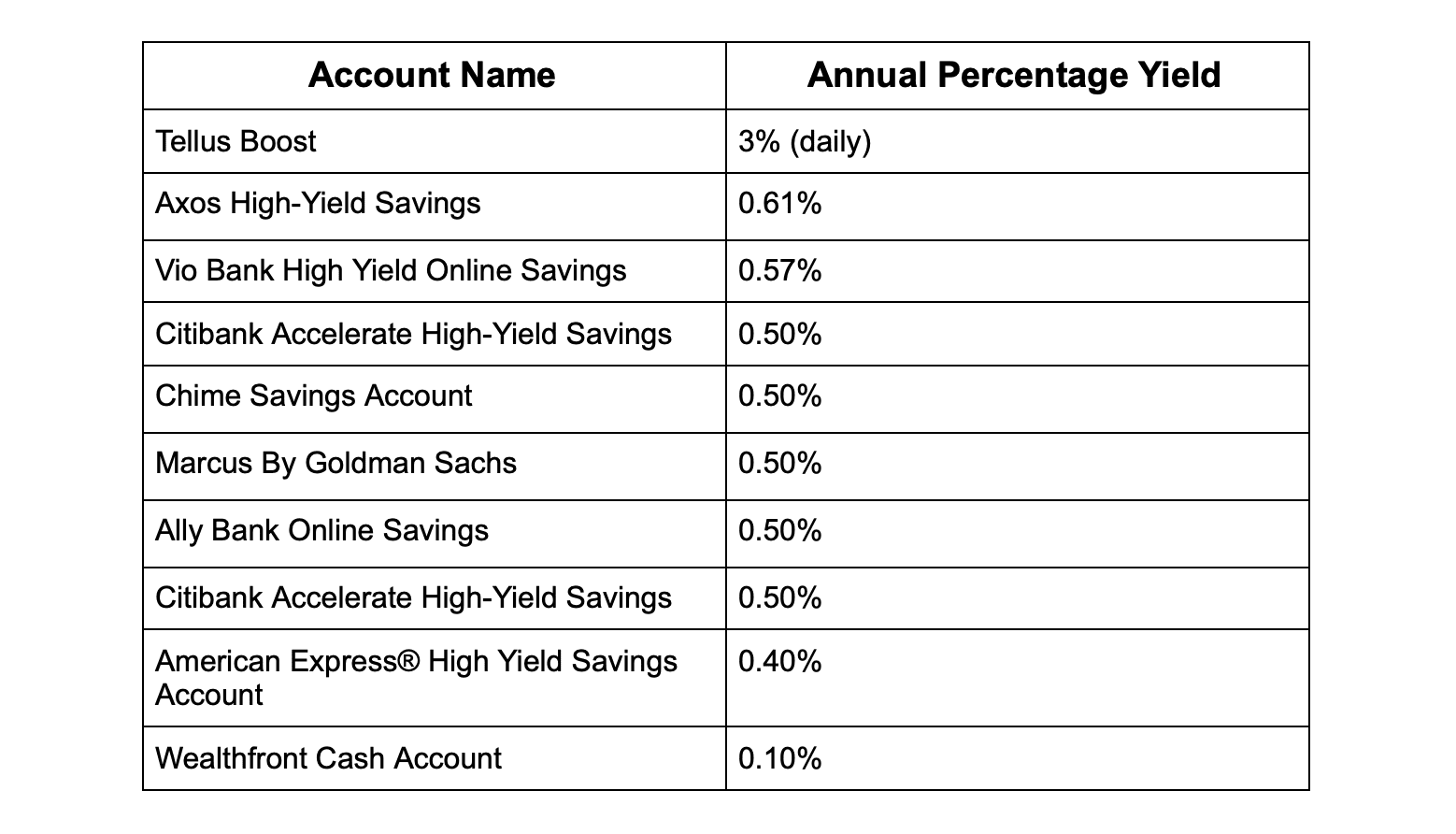

Online banks and cash management accounts tend to offer higher interest rates on deposited cash. Here’s how Tellus Boost compares to some of the best of them:

Online banks and cash management accounts tend to offer higher interest rates on deposited cash. Here’s how Tellus Boost compares to some of the best of them:

As you can see, Tellus Boost’s 3% daily APY is unmatched.

It’s important to keep in mind that Tellus is not actually a bank, nor is it FDIC-insured. But, when you are deciding where to keep your money in order to grow it, Tellus Boost is a pretty compelling offering.

As you can see, Tellus Boost’s 3% daily APY is unmatched.

It’s important to keep in mind that Tellus is not actually a bank, nor is it FDIC-insured. But, when you are deciding where to keep your money in order to grow it, Tellus Boost is a pretty compelling offering.

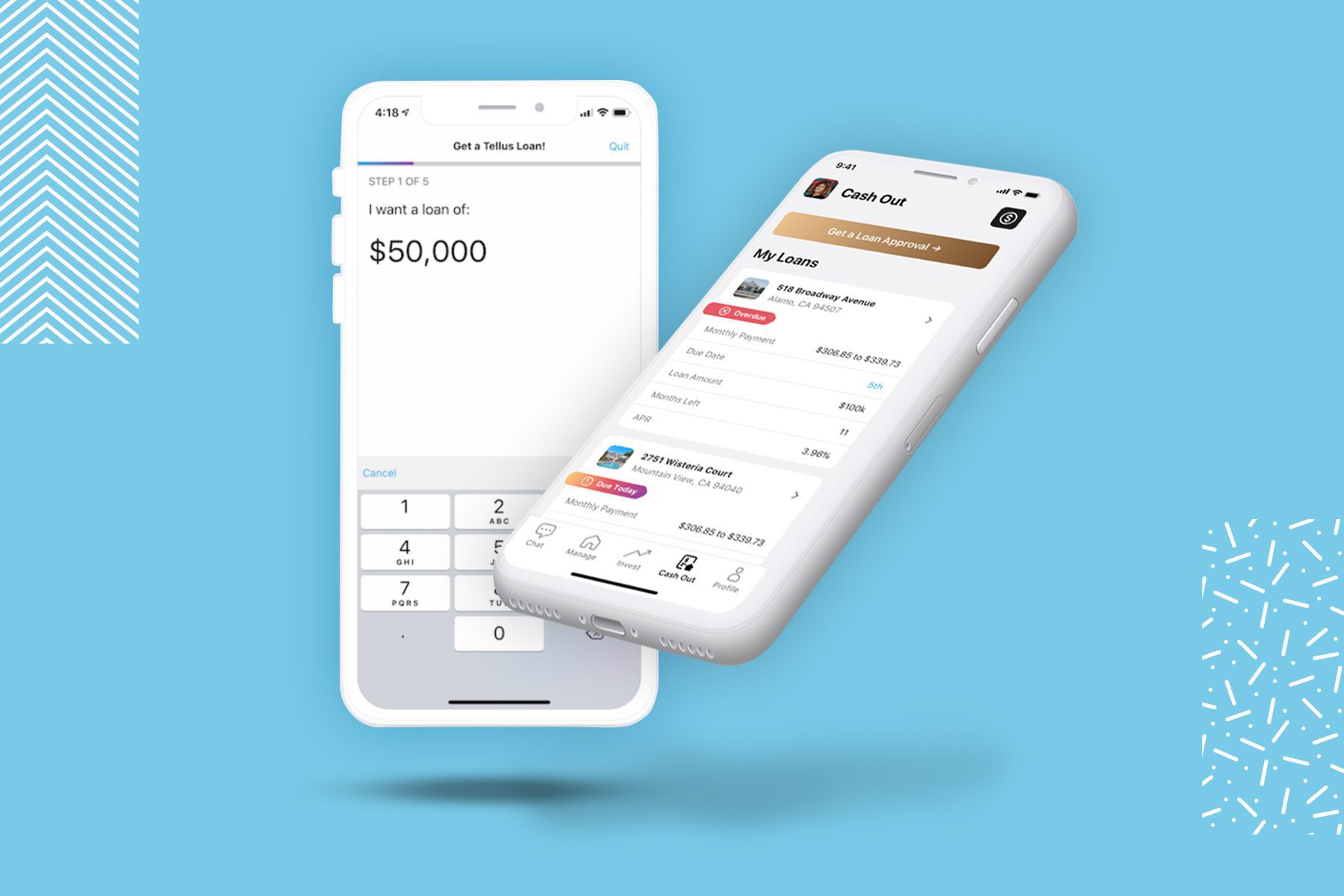

Tellus offers home equity loans to real estate investors and property owners already using Tellus Rental Property Management.

The loans don’t require credit checks for applicants. Instead, loans are based on the value of a property. Tellus home loans have low interest rates ranging between 6% and 10% and unlike a lot of lenders out there, Tellus doesn’t charge borrowers penalty fees for paying their loan back early (it’s crazy that that’s even a thing).

To apply in the app, you first have to create a home profile, which includes providing details about your property, photos of it, and stating how much you are looking to borrow. The application takes less than five minutes to complete and you get your approval decision within 48 hours. If approved, review the terms, accept them and get access to your money within seven days with a simple cash out.

Tellus’ home equity loans cater more towards real estate investors looking to expand their property portfolio and may want to re-leverage their current properties to do so and landlords looking to tap into their property equity as a source of cash.

Of note: Tellus is currently working to scale up this offering, so its home equity loans will not be available to everyone. If you’re looking for it, you may be asked to submit your email and will be put on a waiting list.

Tellus offers home equity loans to real estate investors and property owners already using Tellus Rental Property Management.

The loans don’t require credit checks for applicants. Instead, loans are based on the value of a property. Tellus home loans have low interest rates ranging between 6% and 10% and unlike a lot of lenders out there, Tellus doesn’t charge borrowers penalty fees for paying their loan back early (it’s crazy that that’s even a thing).

To apply in the app, you first have to create a home profile, which includes providing details about your property, photos of it, and stating how much you are looking to borrow. The application takes less than five minutes to complete and you get your approval decision within 48 hours. If approved, review the terms, accept them and get access to your money within seven days with a simple cash out.

Tellus’ home equity loans cater more towards real estate investors looking to expand their property portfolio and may want to re-leverage their current properties to do so and landlords looking to tap into their property equity as a source of cash.

Of note: Tellus is currently working to scale up this offering, so its home equity loans will not be available to everyone. If you’re looking for it, you may be asked to submit your email and will be put on a waiting list.

Signing up for Tellus is pretty simple. Once you download and open the app, you can choose to sign up using your Facebook, Google or Apple account, or with an email or phone number. Once you make your selection, you’ll be asked to provide your first and last name and then whatever info is required for the sign up method you selected.

If you choose a phone number or email, a verification code will be sent to them respectively and you will have to provide it to move forward. On the next page you’ll be asked “What can we help you with today?” and you can choose between opening a cash management account or seeing the property management options. To get started with the Boost account and building your savings, pick that.

Once you’ve created your account, there will be tabs at the bottom of the app to access its various features. The tabs you’ll see will depend on features of the app you’re using.

Signing up for Tellus is pretty simple. Once you download and open the app, you can choose to sign up using your Facebook, Google or Apple account, or with an email or phone number. Once you make your selection, you’ll be asked to provide your first and last name and then whatever info is required for the sign up method you selected.

If you choose a phone number or email, a verification code will be sent to them respectively and you will have to provide it to move forward. On the next page you’ll be asked “What can we help you with today?” and you can choose between opening a cash management account or seeing the property management options. To get started with the Boost account and building your savings, pick that.

Once you’ve created your account, there will be tabs at the bottom of the app to access its various features. The tabs you’ll see will depend on features of the app you’re using.

Table Of Contents

What Is Tellus? Tellus Boost How Is Tellus Able To Offer Such High Interest Rates How Tellus Boost Stacks Up To Other Cash Management And Savings Accounts Tellus Rental Property Management Tellus Home Loans Tellus Investing Signing Up And Navigating The App Final ThoughtsWhat Is Tellus?

Tellus was founded in 2016 initially as a real estate and property management app. Now, it has evolved into an app that provides a variety of financial services including cash management accounts, home equity loans, and, on the horizon, real estate investing. Tellus offers a high-yield cash management account with interest that compounds daily currently at 3% (with opportunities to increase that daily interest), world-class property management tools that streamline various processes for landlords, property managers and renters, and home equity loans with fast online applications and no credit checks. It really is a one-of-a-kind financial services app that is very unique in the marketplace.Tellus Boost

Tellus Boost is the app’s cash management account. What is a cash management account exactly? It’s an alternative to traditional checking or savings accounts. They’re offered by financial institutions that are not banks or credit unions, and typically combine checking, savings, and sometimes even investing account services and features. Many are known to offer competitive interest rates on deposited cash.

Tellus Boost provides a daily compounding interest of 3% on account balances, which is unheard of for any checking account, let alone traditional savings accounts.

Most checking accounts don’t offer interest on deposited cash, and most savings accounts have very low APYs that only end up earning you a few cents on the dollar a year. According to the FDIC, the current national average APY for a savings account is 0.04%. The daily compounding 3% APY that the Tellus Boost account offers is 50 times that. That daily compounding interest really works in your favor to grow your savings quickly — you earn interest on your interest — and you can see it having an impact every single day.

There are also opportunities to boost that APY up to 6% daily by doing simple things like logging into your account daily, completing fun quizzes and referring friends.

There are two kinds of boosts — daily boosts and extended boosts — and only a single boost can be applied at a time. Daily logins and quizzes (which help educate users on personal finance topics), fall into the daily boost category and only last for a day.

Extended boosts, which last longer than a day, are earned by completing special activities like friend referrals to Tellus. This can earn you a few different rewards, like a 1% increase in your daily APY for 30 days, 2x the 3% APY for a week or cash rewards. Right now, Tellus is offering +1% APY extended boost that lasts for a month for referring a friend. Simple math — that brings your Tellus Boost APY up to 4%, which will compound and get paid out daily. Keep an eye out for other special offers like this one since they come and go. They can have a significant impact on your savings.

Tellus really emphasizes its users’ ability to earn interest. Users get real-time updates to the second on account activity and every day they log in to the app they will see how much money in interest they’ve earned that day.

To open and maintain a Tellus Boost account, you have to have a minimum balance of $200. Other than that there are no other requirements and there are no fees.

Tellus Boost is the app’s cash management account. What is a cash management account exactly? It’s an alternative to traditional checking or savings accounts. They’re offered by financial institutions that are not banks or credit unions, and typically combine checking, savings, and sometimes even investing account services and features. Many are known to offer competitive interest rates on deposited cash.

Tellus Boost provides a daily compounding interest of 3% on account balances, which is unheard of for any checking account, let alone traditional savings accounts.

Most checking accounts don’t offer interest on deposited cash, and most savings accounts have very low APYs that only end up earning you a few cents on the dollar a year. According to the FDIC, the current national average APY for a savings account is 0.04%. The daily compounding 3% APY that the Tellus Boost account offers is 50 times that. That daily compounding interest really works in your favor to grow your savings quickly — you earn interest on your interest — and you can see it having an impact every single day.

There are also opportunities to boost that APY up to 6% daily by doing simple things like logging into your account daily, completing fun quizzes and referring friends.

There are two kinds of boosts — daily boosts and extended boosts — and only a single boost can be applied at a time. Daily logins and quizzes (which help educate users on personal finance topics), fall into the daily boost category and only last for a day.

Extended boosts, which last longer than a day, are earned by completing special activities like friend referrals to Tellus. This can earn you a few different rewards, like a 1% increase in your daily APY for 30 days, 2x the 3% APY for a week or cash rewards. Right now, Tellus is offering +1% APY extended boost that lasts for a month for referring a friend. Simple math — that brings your Tellus Boost APY up to 4%, which will compound and get paid out daily. Keep an eye out for other special offers like this one since they come and go. They can have a significant impact on your savings.

Tellus really emphasizes its users’ ability to earn interest. Users get real-time updates to the second on account activity and every day they log in to the app they will see how much money in interest they’ve earned that day.

To open and maintain a Tellus Boost account, you have to have a minimum balance of $200. Other than that there are no other requirements and there are no fees.

How Is Tellus Boost Able To Offer Such High Interest Rates?

So right now, you probably have a few questions running through your mind, like who determines the interest rates for savings accounts? And how is Tellus able to offer such high daily compounding interest then? Well, we have answers.

Interest rates for bank accounts, along with loans, credit cards and so on, are largely influenced by The Federal Reserve (the Fed) — the United States central banking system that’s basically in charge of maintaining the country’s economic and financial stability. It creates national financial policy to regulate banks, manages inflation and interest rates and maximizes employment. The Fed sets what’s called the federal funds rate — how much banks can charge each other to lend funds overnight. Financial institutions then use this as a benchmark to determine interest rates for things like savings accounts. So, if The Fed lowers the federal funds rate, banks and credit unions will likely fall in line and lower interest rates on savings accounts so that they can protect their profits.

The federal funds rate can change multiple times in a year as the economy shifts, and that’s why in 2020 during the height of the pandemic, The Fed issued two emergency cuts to the federal funds rate, bringing it down to a record low of 0 to 0.25%. Even with the economy starting to bounce back, they’ve been slow when it comes to raising interest rates. But, like I said, interest rates for traditional savings accounts have been pretty low for years now. Honestly, you would be lucky to find one with an APY of 1%.

So how is Tellus able to offer 3% daily compounding interest with opportunities to bump that up to 6%? Tellus earns revenue from investments it makes in residential properties via secured loans and account holders get to reap the benefits of that with a high daily APY.

So right now, you probably have a few questions running through your mind, like who determines the interest rates for savings accounts? And how is Tellus able to offer such high daily compounding interest then? Well, we have answers.

Interest rates for bank accounts, along with loans, credit cards and so on, are largely influenced by The Federal Reserve (the Fed) — the United States central banking system that’s basically in charge of maintaining the country’s economic and financial stability. It creates national financial policy to regulate banks, manages inflation and interest rates and maximizes employment. The Fed sets what’s called the federal funds rate — how much banks can charge each other to lend funds overnight. Financial institutions then use this as a benchmark to determine interest rates for things like savings accounts. So, if The Fed lowers the federal funds rate, banks and credit unions will likely fall in line and lower interest rates on savings accounts so that they can protect their profits.

The federal funds rate can change multiple times in a year as the economy shifts, and that’s why in 2020 during the height of the pandemic, The Fed issued two emergency cuts to the federal funds rate, bringing it down to a record low of 0 to 0.25%. Even with the economy starting to bounce back, they’ve been slow when it comes to raising interest rates. But, like I said, interest rates for traditional savings accounts have been pretty low for years now. Honestly, you would be lucky to find one with an APY of 1%.

So how is Tellus able to offer 3% daily compounding interest with opportunities to bump that up to 6%? Tellus earns revenue from investments it makes in residential properties via secured loans and account holders get to reap the benefits of that with a high daily APY.

How Tellus Boost Stacks Up To Other Cash Management And Savings Accounts

Online banks and cash management accounts tend to offer higher interest rates on deposited cash. Here’s how Tellus Boost compares to some of the best of them:

Online banks and cash management accounts tend to offer higher interest rates on deposited cash. Here’s how Tellus Boost compares to some of the best of them:

As you can see, Tellus Boost’s 3% daily APY is unmatched.

It’s important to keep in mind that Tellus is not actually a bank, nor is it FDIC-insured. But, when you are deciding where to keep your money in order to grow it, Tellus Boost is a pretty compelling offering.

As you can see, Tellus Boost’s 3% daily APY is unmatched.

It’s important to keep in mind that Tellus is not actually a bank, nor is it FDIC-insured. But, when you are deciding where to keep your money in order to grow it, Tellus Boost is a pretty compelling offering.

Bonus Features (You Don’t Need To Use These To Get A Great Return On Your Savings)

Tellus Rental Property Management

As I mentioned before, Tellus started as a real estate property management app. It was created with the intended goal of nurturing an easier renting experience for all parties involved, and I have to say, it has succeeded. Tellus offers state-of-the-art real estate management software for rental property owners to help them streamline all aspects of property management. Through the app, they can do everything from listing properties and screening applicants to interacting with their property managers, maintenance team and tenants to collecting rent and tracking expenses. Tellus does all of this totally free of charge. There are a lot of moving parts to rental property management, and the more properties you own, the more difficult it can be to stay on top of everything. Tellus Rental Property Management simplifies and centralizes all of those moving parts. Here’s a list of the different features rental property owners, property managers and their tenants will have access with the app:Landlords

- Manage an unlimited number of properties through the app for free

- List properties and get traffic from the top 16 rental listing websites, including Zillow, Zumper and Trulia

- Offers free renter screening, with applications (tenants pay the fee)

- Collect rent online from tenants with one-tap payments that are kept for your records — everything is categorized and stored in the cloud

- Easily chat with members of your property management team

- Get insights into earnings from rental properties, including which one is yielding the most profits

- Get help claiming the right tax deductions

Property Managers

- Get paid through the app

- Manage and file property expenses and other financial records easily

- Create detailed financial reports that you can export and share

- Chat with co-managers, property owners, tenants, handymen or anyone that needs to be in the loop — you can make as many group chats as you need

- Organize work order request and tickets

Renters

- Pay rent online from your phone — offers autopay features and reminders for peace of mind

- Message your landlord through the app with rental chat

- Submit maintenance requests

- Request reimbursements for services like plumbing or something you bought for the property

Tellus Home Loans

Tellus offers home equity loans to real estate investors and property owners already using Tellus Rental Property Management.

The loans don’t require credit checks for applicants. Instead, loans are based on the value of a property. Tellus home loans have low interest rates ranging between 6% and 10% and unlike a lot of lenders out there, Tellus doesn’t charge borrowers penalty fees for paying their loan back early (it’s crazy that that’s even a thing).

To apply in the app, you first have to create a home profile, which includes providing details about your property, photos of it, and stating how much you are looking to borrow. The application takes less than five minutes to complete and you get your approval decision within 48 hours. If approved, review the terms, accept them and get access to your money within seven days with a simple cash out.

Tellus’ home equity loans cater more towards real estate investors looking to expand their property portfolio and may want to re-leverage their current properties to do so and landlords looking to tap into their property equity as a source of cash.

Of note: Tellus is currently working to scale up this offering, so its home equity loans will not be available to everyone. If you’re looking for it, you may be asked to submit your email and will be put on a waiting list.

Tellus offers home equity loans to real estate investors and property owners already using Tellus Rental Property Management.

The loans don’t require credit checks for applicants. Instead, loans are based on the value of a property. Tellus home loans have low interest rates ranging between 6% and 10% and unlike a lot of lenders out there, Tellus doesn’t charge borrowers penalty fees for paying their loan back early (it’s crazy that that’s even a thing).

To apply in the app, you first have to create a home profile, which includes providing details about your property, photos of it, and stating how much you are looking to borrow. The application takes less than five minutes to complete and you get your approval decision within 48 hours. If approved, review the terms, accept them and get access to your money within seven days with a simple cash out.

Tellus’ home equity loans cater more towards real estate investors looking to expand their property portfolio and may want to re-leverage their current properties to do so and landlords looking to tap into their property equity as a source of cash.

Of note: Tellus is currently working to scale up this offering, so its home equity loans will not be available to everyone. If you’re looking for it, you may be asked to submit your email and will be put on a waiting list.

Tellus Investing

This is a new feature of the Tellus app that’s still in the works, but we’ll give you a peek at what you can expect. Tellus Investing will open up real estate investing to just about anyone. To start investing on the platform, you’ll only need to make a low deposit of $200. Investors will either be able to put their money into mortgage fractions backed by real property, or they can choose the property, city or region they want to invest in. Stay tuned, offering investments along-side the savings features will make this app a real powerhouse. We are excited to watch this develop.Signing Up And Navigating The App

Signing up for Tellus is pretty simple. Once you download and open the app, you can choose to sign up using your Facebook, Google or Apple account, or with an email or phone number. Once you make your selection, you’ll be asked to provide your first and last name and then whatever info is required for the sign up method you selected.

If you choose a phone number or email, a verification code will be sent to them respectively and you will have to provide it to move forward. On the next page you’ll be asked “What can we help you with today?” and you can choose between opening a cash management account or seeing the property management options. To get started with the Boost account and building your savings, pick that.

Once you’ve created your account, there will be tabs at the bottom of the app to access its various features. The tabs you’ll see will depend on features of the app you’re using.

Signing up for Tellus is pretty simple. Once you download and open the app, you can choose to sign up using your Facebook, Google or Apple account, or with an email or phone number. Once you make your selection, you’ll be asked to provide your first and last name and then whatever info is required for the sign up method you selected.

If you choose a phone number or email, a verification code will be sent to them respectively and you will have to provide it to move forward. On the next page you’ll be asked “What can we help you with today?” and you can choose between opening a cash management account or seeing the property management options. To get started with the Boost account and building your savings, pick that.

Once you’ve created your account, there will be tabs at the bottom of the app to access its various features. The tabs you’ll see will depend on features of the app you’re using.

- At the top of the first tab, which has what sort of resembles a computer screen icon, you’ll see your Tellus Boost balance and in the very top right corner, you’ll see an alert for your notifications. Below that, you’ll be able to access your referral code, set up recurring deposits, access APY boost opportunities and will be given the option to like the Tellus Facebook page so you can keep up to date with news and upcoming features. Just below that, you can experiment with a chart to see how much money you can earn with your Tellus Boost account if you change your starting capital, monthly deposit amount and saving time frame. At the bottom, you’ll have access to Tellus Talk, the app’s educational resource.

- If you are a landlord, property manager or renter, the second tab, which has a house icon on it, will be available to you. Landlords and property managers can see whatever properties they’re managing through the platform. You can log income and expenses, view your overall rental finances at a glance, cash out your earnings, view your listings and tenant applications, view rent and lease details and so much more. Renters can pay rent, chat with landlords and property managers, submit maintenance requests and request reimbursements for property services that they paid for out of pocket.

- If you have a Tellus Boost account, with the third tab, which has a dollar sign icon, you’ll be able to get a closer look at your account details, including your balance, interest earned each day and total interest earned. You’ll also be able to make deposits, withdrawals, earn APY boosts and choose exactly how you want to be rewarded for completing extended boost activities.

- The fourth tab is the chat feature, which all Tellus users have access to. Landlords, property managers, tenants and maintenance crew can all chat with one another as needed. And Tellus users can all use chat to communicate with Tellus’ live customer support team. You will see all of your open chats and can archive them when you’re done to decrease clutter.

- The fifth and final tab, which has a person icon, is where you can access your profile details, notifications, your Tellus contacts, files you’ve uploaded ( i.e lease agreements), archived chats and more.