FarmTogether Review: This Platform Is Reinventing How People Invest In Farmland

*Sponsored by FarmTogether

One of the most important things you can do for your investment portfolio is to diversify the asset classes within it. As the saying goes, you don’t want to put all of your eggs in one basket. Having your portfolio too heavily dependent on any one sector or company means you are taking on a lot of risk.

The tricky part here is figuring out what investments to add to your portfolio to get a healthy mix. There is a whole world of investments beyond stocks, funds, and bonds — like blue-chip art, commodities like gold and silver, real estate, and so much more. With FarmTogether you can get started in a sector that can be very lucrative — farmland real estate.

While technically a “real estate” investment, farmland historically has been a very stable investment because you get access to both a booming property type and several other revenue streams within the investment.

In this post, we’ll cover the benefits of adding farmland to your portfolio, what kind of farmland FarmTogether has to offer, how investing on the platform works, and how much you need to get started. So, let’s begin!

Table Of Contents

What Is FarmTogether? Farmland As An Asset Class What Kind Of Farmland Does FarmTogether Offer? Ways To Invest On The Platform Who Can Invest With FarmTogether? What About Fees? Signing Up And Making An InvestmentWhat Is FarmTogether?

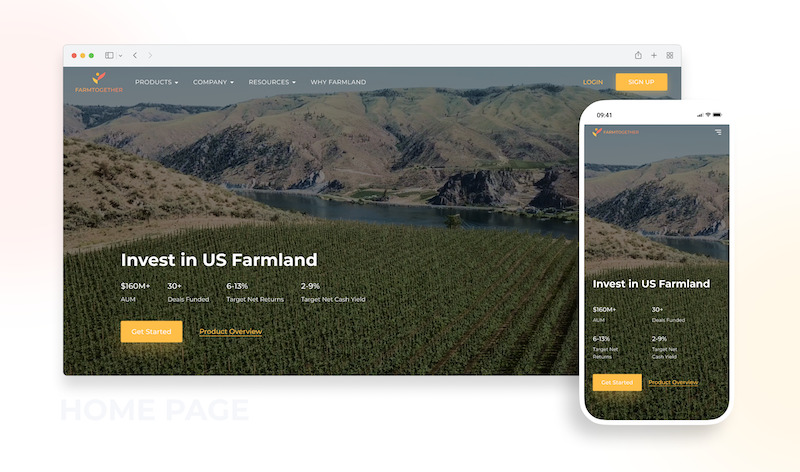

Founded in 2017 by Artem Milinchuk — who comes from a food and agricultural background — FarmTogether (not to be confused with the game with the same name) is a farmland investment manager that specializes in income-producing U.S. farmland, a $2.7 trillion dollar US market. Farmland is a passive investment (also known as buy-and-hold), meaning you hold on to your investment long-term (between 10 to 15 years, sometimes longer depending on the property and deal structure). The company enables accredited investors to access farmland via three products on their platform: their Crowdfunding offerings, Bespoke offerings, and their Sustainable Farmland Fund. Milinchunck’s goal for the investment platform? To drastically democratize farmland investing. All of the farmland offered on the platform is carefully vetted — they target land that can offer 6 to 13% in returns and 2 to 9% in cash yields (all net of fees). The platform partners with local farmland operators to manage the land on behalf of investors. For the time being, the investment platform is only open to accredited investors (we’ll go into detail later about exactly what that means and about income and net worth requirements). That being said, FarmTogether says it is actively researching ways to further democratize farmland investing to allow a broader pool of people to invest.Farmland As An Asset Class

Investing in farmland may seem like an out-there choice, but it can be a very profitable one and historically a safer bet than a lot of the more well-known investment types. Milinchunk, in an interview, explained: “From 1970 to 2021, farmland has returned an average of 11% annually as a composition of both price appreciation and current income. Farmland has also been remarkably stable, experiencing less volatility than both traditional and other alternative asset classes” It’s no wonder that top investors have gravitated towards investing in farmland as of late. Bill Gates is now one of the biggest private owners of farmland in the United States and Warren Buffet, in a letter to his investors in 2014, described farmland as an investment that has “no downside and potentially substantial upside.” Why is this exactly? Think about the theory of supply and demand. The amount of farmland available in the U.S. is decreasing each year. Meanwhile, the global population is continuing to grow. Food (and other agricultural goods) are increasingly in demand, making farmland a valuable asset class. Of course, no investment is without risk, and with farmland specifically, anything from changes in weather patterns to international trade policies to fire, disease, and pests can affect the production and sale of crops, and therefore the value of the farmland. Still, farmland has proven to be a low-risk, high-return investment over time. In previous decades, the only people who had access to the profits that farmland reaps were largely wealthy landowners. That’s not the case anymore. Now, you can buy stocks in agricultural companies and companies in other supporting industries. You can invest in farmland through Real Estate Investment Trusts (REITs), as well as agricultural exchange-traded funds (ETFs), mutual funds, futures contracts and exchange-traded notes (ETNs), and more. And for those who want to maximize the returns farmland has to offer, there is now the option to invest directly into farmland via private equity, invest in an already diversified fund via a single allocation, or, if you have the means, through direct purchase, all of which are options with FarmTogether.What Kind Of Farmland Does FarmTogether Offer?

Right now, FarmTogether has a limited and specific selection of available farmland on offer. The platform specializes in permanent crops — like fruits and tree nuts — in California and the Pacific Northwest, seeking out land with strong water availability and high-grade soil. However, over the past year they’ve expanded their offerings across the US, such as into Oklahoma, Illinois, and Idaho, as well as into row crops, aiming to offer a diverse range of deals to suit different investment goals and objectives. Check FarmTogether’s website to see what investment opportunities are currently available.Ways To Invest On The Platform

FarmTogether provides threeways to invest with the platform: crowdfunded farmland offerings, sole ownership bespoke offerings, and a farmland fund. What’s the difference? Here’s a breakdown:Crowdfunded Farmland Offerings

- For this option, you can become a partial owner of a farm, sharing in its profits

- Investment offerings are available to accredited investors (see below on exactly what that means) with a low minimum of $15,000.

- FarmTogether may utilize leverage to improve the offering’s returns

- Hold Periods starting from 10 years

- Eligible for 1031 Exchanges

- Simple and low fees

Sole Ownership Bespoke Offerings

- With this option, you can become the sole owner of a farm

- Farmland sourced for individual investors who seek sole ownership and are willing to invest $1,000,000+ in equity per row crop farm, and $3,000,000+ in equity per permanent crop farm

- Fully customizable legal, tax, and capital structure. Hold period, risk-return profile, and cash yield profiles are at the sole discretion of the investor

- Eligible for 1031 Exchanges

- Custom fees aligned with the deal structure

- Diversified exposure to a portfolio of farmland

- Farmland sourced for individual investors who seek diversified exposure via a single allocation of $100,000+.

- Private evergreen fund structure

- 2-year lock-up period

- Fees are dependent upon the amount of your investment in the FarmTogether Sustainable Farmland Fund

Who Can Invest With FarmTogether?

Not everyone is able to invest with FarmTogether — though again, the platform says they are working to expand their offerings. Currently, to invest on the FarmTogether platform you have to be one of the following:- An accredited investor – Someone whose annual income for the last two years exceeds $200,000 individually (or $300,000 jointly), with the expectation you will earn the same or more in the current year. Or, you must also have a net worth greater than $1 million (individually or jointly), excluding the value of your home.

- A registered investment advisor (RIA) – A person or firm that specifically advises and manages investment portfolios for individuals.

- A wealth manager – A type of financial advisor that works with high-net-worth and ultra-high-net-worth individuals on portfolio management, accounting, estate planning, retirement planning, tax services, and more.

- A bank, insurance company, business development company, or small business – A business can invest with the platform if all of the business’ equity owners are accredited investors or if its total assets are over $5 million. The $5 million benchmark also applies to employee benefit plans — self-directed Income Retirement Plans (IRA) and Self-Employed 401ks (Solo 401k) — trusts, charitable organizations, and partnerships.

What About Fees?

FarmTogether doesn’t charge any fixed fees. Instead, fees vary from deal to deal and can be viewed on the investment opportunity page of each farmland offer. There is a one-time origination fee and an annual management fee. Both are dependent on an offers’ total deal size. So for example, FarmTogether’s offering, Deer Creek Pistachio Orchard, which has an offering size of nearly $3.2 million, has a 2% origination fee and a 1.5% annual management fee. Meanwhile, Fawn Creek Pistachio Orchard, which has an offering size of nearly $2.4 million, has a 2% origination fee and a 1% annual management fee.Signing Up And Making An Investment

Signing up is easy. Just navigate to the homepage and hit the sign-up button. You’ll be taken through a multiple-choice questionnaire to assess what kind of investor you are, your investing experience and how strong your intent is to invest with the platform. Once you finish with that, you’ll be asked to provide your first name, last name, and email address. On the next page, you’ll be asked to confirm your email address with a code that will be sent to it, create a password and provide a phone number. From there, you can access the FarmTogether website in full and view details about current offers on their individual pages and summaries for past offers. So what will you see on an offer page? A lot! Below is a list of just some of the things you’ll be able to access:- An overview of the land, including exact size, valuation, further development plans for it, and a financial summary

- Due diligence materials, including production history and a property’s water access

- An earnings projections calculator you can play with to see what your net return could be depending on your investment amount

- The hold period

- A detailed written report (and webinar video) on the commodity being grown on the farmland, including historical performance

- A breakdown of fees and the land’s ownership structure

- Important documents related to the property, including operating partner details and private placement memorandums