Sezzle Reviews – Pros and Cons in 2025

Have you ever applied for a credit card?

You get that rush of excitement, dreaming about what you’re going to buy once you have that shiny new card in hand.

And then comes the denial letter.

I know that sinking feeling of defeat.

You’re left looking for other ways to buy the things you want.

Luckily, I found Sezzle.

Not only is Sezzle easy to use, but it’s also a breeze to get approved for.

Below, I’ll cover everything you need to know about this buy now, pay later service and explore some real Sezzle reviews.

What is Sezzle?

Source: Sezzle

Sezzle is a buy now, pay later (BNPL) service available in the U.S. and Canada. It allows users to borrow a minimum of $35 and up to $2,500 interest-free to be paid back using a pay-in-four payment plan.

When you choose Sezzle at checkout, you’ll pay a downpayment of 25% and then 25% every second week until the loan is paid off in six weeks. Sezzle uses autopay, so you won’t have to worry about making payments manually.

Upon signing up, Sezzle will approve you for purchases typically ranging from $50 to $100. As you build a history with Sezzle, they’ll increase your spending limit. This limit can vary depending on the retailer.

Now Sezzle isn’t just for online purchases. You can also use your Sezzle virtual card to make purchases in-store at participating retailers. Simply tap to pay (later) with your virtual Sezzle card.

Sezzle also has a loyalty program called Sezzle Spend. They run promotions that reward you with cashback. This cashback can be used towards future purchases in the app.

What is Sezzle Up?

The problem with building credit is that you need a good credit score to get a credit card, which causes problems for young adults with a zero credit score or a bad payment history.

This is where Sezzle Up can help.

While a regular Sezzle buy now, pay later account doesn’t affect your credit, Sezzle Up will file your payments with the major credit bureaus.

This is perfect if you can’t qualify for a regular credit card but want to build credit. There are no minimum credit score requirements, so qualifying is simple.

It’s also free to upgrade to a Sezzle Up account. After you make your first installment payment on time, you’ll qualify for Sezzle Up.

Sezzle Up reports payments at the end of every month. It will show up on your report as a line of credit, so any future lenders will think it’s a regular credit card.

You’ll find plenty of online Sezzle reviews talking about how this application helped users all over the U.S. and Canada build good credit.

If you need more help fixing your credit, check out our comparison of Credit Saint vs Lexington Law, or see if working with the best tradeline companies could be the right credit repair solution for you.

Meanwhile, learn how to budget for non recurring expenses so you can be prepared for unexpected costs going forward.

How To Use Sezzle

Are you ready to get started with flexible, interest-free loans?

Below is a guide on how to shop responsibly with Sezzle:

- Sign up for a Sezzle account

- Shop like you normally would

- Track your orders and payments

- Pay your installments on time

Step 1: Sign Up For A Sezzle Account

To qualify for a Sezzle buy now, pay later account, you must meet the following criteria:

- Be 18 years or older

- Have a U.S. or Canadian phone number

- Have a U.S. or Canadian debit or credit card

If you meet these qualifications, sign up for an account on the Sezzle website or download the mobile app.

Sezzle will ask for your full name, phone number, email address, and date of birth. They’ll confirm your phone number using a one-time pin (OTP), and you’ll have to agree to their terms and conditions.

The last part of the application process is a soft credit check that only takes a few seconds to complete. Sezzle provides immediate approval, and if your application is unsuccessful, Sezzle will give you the reason why.

There’s no limit to how many times you can apply. So once Sezzle gives you feedback on why your application was unsuccessful, focus on improving and apply again when the issue is fixed.

Step 2: Shop Like You Normally Would

Source: Sezzle

Sezzle works at over 47,000 stores worldwide. Here are some well-known examples:

- Amazon

- Target

- Sigma Beauty

You can access these retailers by going to the Sezzle mobile app and selecting the store you want to buy from. Shop like you usually would and select the Sezzle buy now, pay later option at checkout.

Sezzle also has a virtual card option for in-store shopping at select retailers.

Online Sezzle reviews also mention that customers get access to exclusive discounts. For example, if you’re buying a new water bottle from HydroJug, you can get 15% off by using Sezzle at checkout.

Step 3: Track Your Orders And Payments

Once you’ve made your purchase, track your order and future payments on the Sezzle mobile app.

Sezzle tells you exactly when your following three payments are due, so you can plan ahead. You can even export these dates into your Google Calendar for an additional reminder.

If you can’t make the payments on time, Sezzle offers one free rescheduling.

This won’t harm your credit score, but if you want to reschedule your payment plan for the second or third time, you’ll have to pay a fee based on your current account balance.

Step 4: Pay Your Installments On Time

Source: Sezzle

If you’re using a regular Sezzle account, you won’t have to worry about your credit score because Sezzle doesn’t affect your credit.

But if you signed up for Sezzle Up, the most critical step is paying your installments on time.

You want to show future lenders that you’re a responsible consumer, capable of handling debt and making payments. If your payments are late, it could decrease your chances of qualifying for bigger loans down the road.

Fortunately, Sezzle comes with autopay, so they’ll withdraw the amount from your bank account on the due date for you.

If for some reason, your payment is not made on time, Sezzle will charge a late fee (this is usually around $10). However, if you resolve the payment within 48 hours, Sezzle will waive the fees charged.

Sezzle charges a convenience fee for payments (after the initial installment) made using a credit or debit card, so I recommend linking your bank account directly. You’ll be warned of any possible fees prior to the charges appearing on your account.

You can also use Sezzle Spend to pay your downpayment. Simply checkout like you usually do, but next to the Sezzle option, you’ll find a Sezzle Spend alternative. Choose this payment method, and you’ll be able to use your rewards cash to pay.

Is Sezzle Legit?

Sezzle is a legit buy now, pay later service.

There are over 100,000 Sezzle reviews in the Apple App Store, with an average rating of 4.9 stars.

On Trustpilot, Sezzle has a rating of 4.5 stars, which shows that most customers have positive experiences.

Plus, Sezzle is a public company, so its financial records are viewable by everyone.

Is Sezzle Safe?

Sezzle is a safe buy now, pay later service.

It uses 128-bit encryption and multi-layered firewalls to protect your data. This means you won’t have to worry about your personal data falling into the wrong hands.

However, the Sezzle Google Play page states that Sezzle sells your data, like your full name, email address, and location, to third parties for advertising purposes. This could be a concern if you want to keep all of your data private.

Sezzle Reviews

Sezzle is one of the most highly-rated buy now, pay later companies. But don’t take my word for it.

Here are some Sezzle reviews from existing customers:

Source: App Store

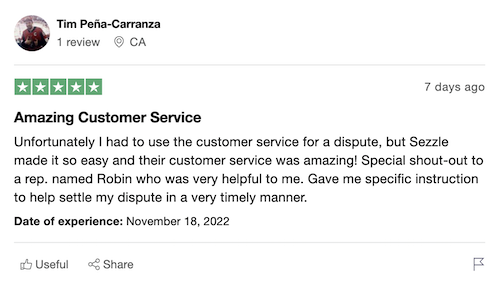

Many Sezzle reviews also talk about the friendly and helpful customer support team.

Source: Trustpilot

The one thing I would warn other users of is to be aware of tactics BNPL companies use to encourage consumers to buy more than they need. The main way they do this is by making your total at checkout appear smaller than it actually is.

So, be aware and know that although you may only owe 25% down today, you’ll still be paying the full 100% over time.

Commonly Asked Questions About Sezzle

How Trustworthy is Sezzle?

Sezzle is a trustworthy buy now, pay later service. There are over 100,000 Sezzle in the App Store with an average rating of 4.9 stars. Investors also trade Sezzle shares on the public market, so all their financial documents are available online.

Does Sezzle Hurt Your Credit?

Sezzle doesn’t hurt your credit score because it only conducts a soft credit check. Unlike hard inquiries, soft checks won’t appear on your credit report. But remember that Sezzle reserves the right to report your account, so if you stop making payments, it could end up on your credit report.

To learn which budgeting app could best help you manage your finances and boost your savings, check out these comparisons of Rocket Money vs the competition:

Then use a net worth tracker to see how your new financial strategies are paying off.

Does Everyone Get Approved For Sezzle?

Although approval isn’t guaranteed, meeting Sezzle requirements is easy. There’s no minimum credit score. All you need is to live in the US or Canada, have a valid phone number and email address, and have a valid credit or debit account to be eligible.

Does Sezzle Build Your Credit?

A regular Sezzle account doesn’t affect your credit. But if you’re using Sezzle Up, you’ll be able to build your credit score as Sezzle will report your payments to the three major credit bureaus. There’s no minimum credit score required, so it’s an easy way to build credit.

How Does Sezzle Work?

Sezzle works by paying merchants upfront and then collecting payments from you after. You’ll pay 25% down at checkout, then 25% every second week following until your purchase has been paid in full over six weeks.

Sezzle Minimum Credit Score?

Sezzle doesn’t have a minimum credit score requirement, so most people do qualify. If you’re looking to build credit, you’ll be glad to know that by upgrading to Sezzle Up, Sezzle will report your payments to the major credit bureaus.

Is Sezzle Like Afterpay?

Sezzle and Afterpay are both buy now, pay later apps, but with key differences. Afterpay is a more established firm, so they start you off with higher limits, usually around $600. Afterpay also has different fee schedules. Check out my full Afterpay review!

How Much Does Sezzle Approve You For?

Sezzle starts you off with smaller amounts, usually around $50 to $100. As you show them that you’re a responsible consumer by paying off your loans on time, Sezzle will increase your limit. The highest limit that Sezzle currently offers is $2,500.

What Are Sezzle Alternatives?

- Perpay (read this full PerPay review to learn more)

- Afterpay (read these Afterpay reviews to learn more)

- Affirm (read these Affirm reviews to learn more)

- Zilch (read this full Zilch review to learn more)

- Nelo (read this Nelo review to learn more)

- Klarna (read these Klarna reviews to learn more)

- Zip (read these Zip reviews)

- PayPal Pay in 4 (read these PayPal Pay in 4 reviews to learn more)

- Splitit (read this Splitit review to learn more)

- Apple Pay Later (read this Apple Pay Later review to learn more)

- Sunbit (read this Sunbit review to learn more)