Splitit Review – Pros and Cons in 2025

Pay for your purchase in smaller chunks. Earn credit card rewards while paying. There’s no application or approval process.

So what’s the catch?

You’ll find out in my Splitit Review!

Splitit is a cool spin on Buy Now, Pay Later (BNPL) services. I think it’s sweet for certain people. But I think it’s not what other folks need.

84% of Americans have a credit card, according to the Federal Reserve. This means 16% of Americans can’t use Splitit. That’s because Splitit works with your credit card.

This has pros and cons. I’ll explain!

What is Splitit?

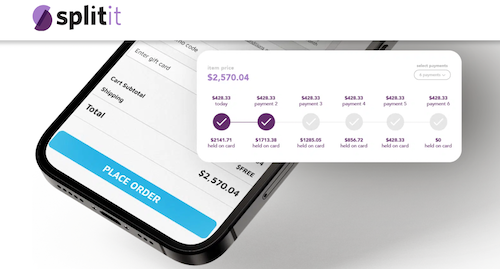

Splitit is a payment solution that allows you to pay in installments using your existing credit card without fees, applications, or credit checks.

Splitit is designed for responsible credit card users who do not want to take out a new loan.

Source: Splitit

Warning: Splitit itself does not charge additional fees. But remember, you’re putting the purchase on your credit card. And if you fail to make your installment payments on time, the credit card may charge you a fee.

The flip side is positive. Since you’re actually using a credit card, if your credit card has a rewards program, you’ll earn those points or cash back.

Splitit says their mission is to enable consumers to use their earned credit to pay for what they want and need on their own terms.

Splitit made a 60-second explanation video:

Splitit’s CEO, Nandan Sheth, describes Splitit this way, “There is unparalleled demand for its innovative payment option letting consumers use their existing credit, rather than new financing, for spreading out large purchases.”

On LinkedIn, Splitit proudly proclaims to stores, “It’s a new day for payments—one where your shoppers can keep earning the credit card rewards they love, choose the number of installments, and gain a level of control that traditional buy now, pay later providers can’t – or won’t – give them.”

How To Use Splitit

Splitit is a payment solution that allows you to pay for purchases in installments using your existing credit card.

Splitit works with Visa, Mastercard, Discover, and Union Pay credit cards.

It works by placing a hold on the user’s credit card for the total amount of the purchase, but this is not a payment and does not accrue interest!

You can choose the number of monthly installments that suit your budget.

Source: Splitit

The first installment is charged a few seconds after the purchase authorization or upon shipping, and Splitit reauthorizes the outstanding amount when the previous authorization is about to expire.

Splitit will charge your credit card every month until the plan is finished, reducing the hold on the credit line by the payment amount each month. You can benefit from rewards, transaction insurance, and protection against fraud when using Splitit.

Is Splitit Legit?

Yes, Splitit is legit. Splitit is listed on the Australian stock exchange and is headquartered in Atlanta. Splitit was founded in 2012.

Source: Splitit

Splitit’s CEO, Nandan Sheth, has over 20 years of experience as an executive at major global fintech and payment companies, including American Express.

Trustpilot tallies over 3,000 individual Splitit reviews averaging 4 stars. However, this does NOT mean Splitit is perfect.

Overall though, Splitit is a legit Buy Now, Pay Later (BNPL) service and worth trying out to see for yourself.

Splitit was named to the Deloitte Technology Fast 500 North America list in 2022. It’s listed as the 114th fastest-growing technology and life sciences company in North America.

Is Splitit Safe?

Splitit looks to be safe. The company makes money from merchants in the form of fees.

It promises not to sell your data or upsell you other products.

On Reddit, I found this Splitit review conversation about buying a bicycle using Splitit.

The response was:

Many of the negative reviews I’ve researched are from folks who didn’t understand how Splitiit works. For instance, Splitit puts a hold on your credit card for the full amount and reduces that hold each time you pay. So, in essence, you shouldn’t spend beyond this amount if you’re up against your credit limit.

Splitit Reviews

Source: Trustpilot

From what I can tell, the next review, Brian, didn’t understand that Splitit does NOT charge you the full amount. It puts a HOLD on your account for the full amount. But you are only charged for the first installment.

Source: Trustpilot

Source: Trustpilot

Source: Trustpilot

Source: Trustpilot

Commonly Asked Questions About Splitit

Does Splitit Affect Credit Score?

Splitit says it does NOT impact your credit score. The reason is Splitit uses your existing credit on your credit card rather than new credit.

However, missing a payment will actually hurt your score because the credit card with which you used Splitit will report it.

If you need help fixing your credit, check out our comparison of Credit Saint vs Lexington Law, or see if working with the best tradeline companies could be the right credit repair solution for you.

Meanwhile, learn how to budget for non recurring expenses so you can be prepared for unexpected costs going forward.

To learn which budgeting app could best help you manage your finances and boost your savings, check out these comparisons of Rocket Money vs the competition:

Then use a net worth tracker to see how your new financial strategies are paying off.

Splitit Vs Afterpay?

Splitit touts that they are the only installment payment solution allowing shoppers to use their existing credit card at checkout. Afterpay and other Buy Now, Pay Later (BNPL) services require you to take out an additional line of credit.

With Splitit, customers don’t fill out an application or need approval. You DO need a credit card, though.

With Afterpay, you can pay via credit card, debit card, or bank account.

Afterpay limits the amount you can spend based on your credit profile. With Splitit, that limit is determined by the credit card you’re using.

Afterpay uses a soft credit card to approve you for their service.

With Afterpay you make 4 payments over 6 weeks, with the first payment due right away. With Splitit, you can pay in more installments over a longer time. So you can pay smaller amounts.

Do remember, though, that Splitit will place a hold for the full amount on your credit card. This amount is NOT due. BUT, this is how Splitit guarantees you’ll eventually pay the full bill.

Splitit Vs Affirm?

You must have a credit card to use Splitit. Affirm users can pay in other ways, such as with a debit card.

Splitit does NOT run a credit check. Affirm runs a soft credit pull to approve or deny you.

A cool aspect of Splitit is that since you’re using your credit card, you’ll be earning whatever rewards your credit card normally gives you. This is a unique benefit I’ve found while researching my Splitit review.

With Affirm’s Pay-in-4 option, there are no interest charges. With Splitit, you’ll pay whatever your credit card would charge you for missing payments. However, with Splitit, you can set up as many as 36 monthly payments to lower your monthly bill.

Splitit Vs Klarna?

Both Splitit and Klarna are methods to pay a bill over time. Splitit requires you to have a credit card. Klarna does not.

Klarna requires approval. Splitit does not require approval because it uses a credit card you already have.

Is Splitit A Good Idea?

In this Splitit review, I’ve discovered that Splitit is a good idea for folks who:

- Have a credit card

- This credit card has an available limit to cover the total cost of what they want to buy, plus their other usual expenses

- Want to split up the total cost in equal installments over anywhere from 3 to 36 months

- Feel confident they will make all the monthly payments, so their credit card doesn’t charge them interest

How Exactly Does Splitit Work?

Splitit is a payment service that allows you to make purchases on a credit card and pay for them in installments.

When you make a purchase with Splitit, you are charged for the first installment immediately, and subsequent installments are automatically charged on the same date each month.

In order to guarantee the payments to the retailer or merchant, an authorization (hold) is also placed on your credit card for the full outstanding amount of your plan. This authorization (hold) is renewed every 18-21 days and decreases with each installment payment made.

The only charges that will appear on your credit card bill are the monthly installment payments.

Is Affirm or Splitit Better?

If you don’t have a credit card, Affirm is better because you can’t use Splitit without a credit card!

With either Affirm or Splitit, I recommend you use them only if you feel confident you will be able to pay each installment in full. Otherwise, you will be charged.

How Is Splitit Different To Afterpay?

Splitit is a payment service that allows customers to pay for purchases in installments using their existing credit cards. Customers do not need to apply or get approved to use Splitit, but they do need a credit card. The amount that can be spent using Splitit is determined by the credit limit on the card, while Afterpay’s spending limit is based on the customer’s credit profile.

Afterpay requires customers to make four payments over six weeks, while Splitit allows for more installments over a longer time period. Splitit places a hold for the full amount on the customer’s credit card as a guarantee of payment.

Minimum Credit Score For Splitit?

There is no minimum credit score for Splitit. That’s because Splitit uses your existing credit card. You can’t use a debit card or other payment with Splitit.

How Does Splitit Make Money?

Stores pay Splitit to use its service. The stores like Splitit because it makes their products more affordable for customers.

What Are Splitit Alternatives?

- Sezzle (read full Sezzle review here)

- Perpay (read this full PerPay review to learn more)

- Afterpay (read these Afterpay reviews to learn more)

- Affirm (read these Affirm reviews to learn more)

- Zilch (read this full Zilch review to learn more)

- Nelo (read this Nelo review to learn more)

- Klarna (read these Klarna reviews to learn more)

- Zip (read these Zip reviews)

- PayPal Pay in 4 (read these PayPal Pay in 4 reviews to learn more)

- Apple Pay Later (read this Apple Pay Later review to learn more)

- Sunbit (read this Sunbit review to learn more)