How Easy Is TD Ameritrade For New Investors? We Investigate

In a sea of upstart online investment brokerages — some with just a few years under their belts — TD Ameritrade is a stalwart in the space. Founded in 1975, TD Ameritrade is one of the most recognizable names in the investing space. Being the experienced player on the block has its advantages, and TD Ameritrade has earned a reputation for being one of the best options for beginner investors because of its educational resources and stellar customer service.

Some of the newer offerings online brokerages have become known for — like the ability to trade cryptocurrency — just aren’t there yet with TD Ameritrade, though.

There is a lot to unpack as to whether TD Ameritrade is the best app for beginner investors. We’ll dive into the good, the bad, and what active users really think of TD Ameritrade in our complete review.

Table Of Contents

TD Ameritrade At A Glance

Our Verdict: This is one of the best apps for beginner investors. It makes it easy to get started, has a very low-fee structure, including with the funds that it offers, and it boasts stellar customer service. People interested in investing in fractional shares and cryptocurrency, though, should go elsewhere.

Pros and Cons TD Ameritrade

As you make your decision as to whether TD Ameritrade is the right investing app for you, be sure to research the other options. We’ve compiled a complete guide to investing apps for every type of investor.

TD Ameritrade Review: Is It Good For Beginners?

An investing app that is good for an experienced investor or for active trading, isn’t necessarily the right option for someone who is just starting out in their investing journey. With that in mind, we wanted to dive into whether TD Ameritrade is a good pick for beginner investors specifically. Here are a few data points to consider in your decision making process.

What TD Ameritrade Does Well For Beginner Investors

TD Ameritrade is one of the best options for beginner investors. There is no account minimum to get started and, for the most part, it offers no commission stock trading. The one exception is for those who plan to trade securities not listed on major exchanges. In those cases, users will pay small fees. Of note, this isn’t going to be an issue for beginner investors.

TD Ameritrade offers two trading platforms. There is TDAmeritrade.com — which is predominantly where our focus will be. This is the platform for beginner investors to research, trade stocks from the stock market, funds (i.e. mutual funds, ETFs, and index funds), bonds, and CDs. It also includes a tool called GainsKeeper to aid users in properly paying taxes on investment gains and losses.

TD Ameritrade also has a trading platform called Thinkorswim aimed at more advanced investors who are active traders. The platform comes equipped with analysis tools and studies, ways to create customizable screeners and charting, backtesting capabilities, real-time news, quotes, market heat maps and more.

Both options have a desktop version and a corresponding mobile version.

One of the places that TD Ameritrade shines is with the abundance of low-cost mutual funds it offers — over 500 on the platform with expense ratios of .50% or less (if you want our investment advice, investors look for expense ratios below .75%). It also offers 1,000 funds with investment minimums of $100 or less.

TD Ameritrade’s customer support is one of its biggest selling points, particularly for beginner investors. It’s 24/7 and available via almost every medium from texting to social media. There are also more than 250 physical branches across the US. Locked out of the trading platform for whatever reason? You can reach out via Twitter by contacting TD Ameritrade in their DMs.

This is a pretty stark contrast to how many upstart online brokerages function — some of which don’t even list a phone number on their website, for comparison.

Its educational resources are also best in class. For instance, TD Ameritrade offers investing courses, instructional videos to better understand investing, webcasts on investing and in-person and virtual events.

TD Ameritrade’s virtual trading simulator — essentially a mock trading account called TD Ameritrade paperMoney virtual simulator — is also unique in this space. Users get $100,000 in practice money to test out trading. For those nervous to get their feet wet with real money, this is a great opportunity.

What TD Ameritrade Could Do Better For Beginner Investors

TD Ameritrade has a lot of great offerings for beginner investors but one place where it really falls short is that it doesn’t offer fractional shares. As a refresher, fractional shares allow people to buy shares of a stock based on the dollar amount they want to spend rather than buying full-shares (say, buying $10 of Amazon stock versus a full share which is over $3,500 as of November 9, 2021).

Online brokerages from Fidelity to Charles Schwab (which of note, acquired TD Ameritrade in late 2020) have added fractional shares as a part of their offerings, so TD Ameritrade is in the minority here.

Cryptocurrency is another place that TD Ameritrade falls short — it does not offer crypto trading on the platform. Of note, certain qualified clients are able to trade Bitcoin futures and micro Bitcoin futures via TD Ameritrade. Still, this is a major drawback given the intense interest in cryptocurrency at the moment.

Lastly, some users of TD Ameritrade express frustration over surprise fees for certain types of transactions, like receiving foreign dividends. This likely wouldn’t be an issue for beginner investors, but something to keep on your radar should you start to make more advanced transactions.

What Real Users Think About TD Ameritrade

The Good

Real users of TD Ameritrade are quick to praise the online brokerage for its stellar customer service — something not many of its competitors offer. Per one reviewer on Consumer Affairs: “It is the only brokerage account that you can actually speak to somebody in person right away.”

Another reviewer praised the many tools that TD Ameritrade makes available to beginner investors. “With their mobile app and online tools together with live support I actually feel like a pro,” the reviewer wrote.

The Bad

Users have been critical of the fees they accrued for using TD Ameritrade. Of note, the fees these users describe are for trades that would most likely be done by much more advanced investors. Per a review in ConsumerAffairs: “I wasn’t too keen on the occasional $1-$4 fees I was being charged for foreign dividends, but they hit my account with a $38 fee… FOR A REVERSE SPLIT?”

Another reviewer didn’t like the availability of charting options on the platform, again, something that would go largely unnoticed by a beginner investor but could be important to a more advanced investor.

Summary Section

This is a really stellar app for beginner investors. No minimum balance requirements and $0 commission fees for online equity, options, and ETF trades for U.S.-based customers are exactly the kinds of things beginner investors should look for in an online brokerage. Take advantage of free trading whenever you can. Customer service is a standout, with the ability to get on the phone to talk to a real human or even to visit a branch in person.

The other thing that TD Ameritrade offers is exceptional resources for beginner investors. Between online investing courses, in-person events, and even a trading simulator to play around with, beginners who are eager to learn more about investing are sure to come away impressed.

Now, as someone becomes more skilled and is interested in more advanced trading transactions, they might find that they outgrow TD Ameritrade, especially as they face fees for certain transactions. But for the beginner investor looking to get their feet wet, and looking to grow their wealth over time, this is a great option.

FAQs

TD Ameritrade FAQs

Does TD Ameritrade Have Fees?

TD Ameritrade offers $0 commissions for online equity, options, and ETF trades for U.S.-based customers. It does charge $44.99 for broker-assisted trades and $49.99 for mutual funds outside the no-fee list. Of note, while these fees may seem hefty, other online brokerages, like Robinhood, for example, don’t offer broker-assisted trades or mutual funds. TD Ameritrade also charges a $0.65 per contract option fee.

How Do You Buy Stock On TD Ameritrade?

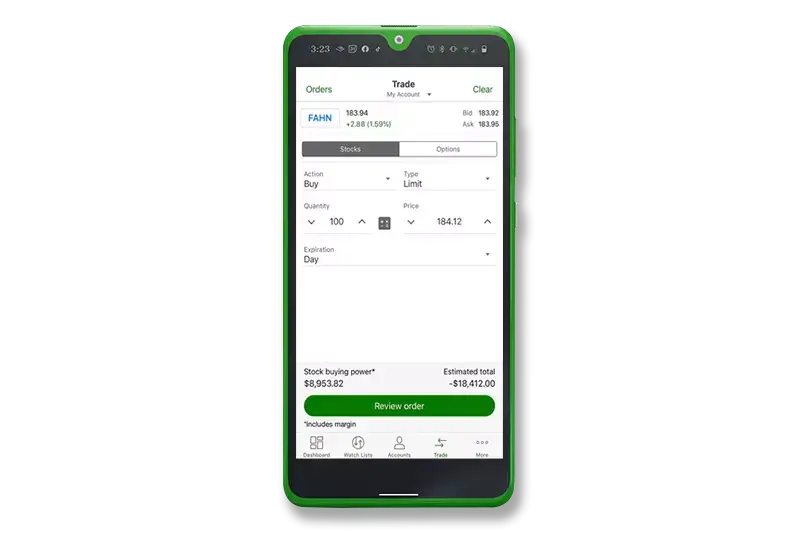

Buying stock on TD Ameritrade is easy:

- First, open an account and log in.

- Click Trade > Stocks & ETFs > Buy/Sell from the main menu.

- Use the Action menu and select Buy.

- Enter the quantity of shares you want to buy as well as the symbol for the stock or fund you are buying.

- Then, select an order type, set a price, and select a time-in-force.

Is TD Ameritrade Free?

TD Ameritrade has no deposit minimums or trading minimums. There are also many things you can trade commission-free via TD Ameritrade. That being said, there are some trades where users will incur fees, including broker-assisted trades. Read the fine print.

Does TD Ameritrade Offer Retirement Planning Resources?

TD Ameritrade has several resources for you including help for finding which IRA is right for you, managed portfolios, and retirement income solutions. They offer complimentary goal planning sessions to help you define your goals and create an investment plan to suit them. There’s a lot of resources available to help you whether it’s just for the near term or the next 20 years.

FAQs On Online Trading

What Are Online Brokerage Accounts?

A brokerage account is the account type a person needs to open in order to buy and sell stocks, bonds and mutual funds. Just like with a bank account, you can transfer money in and out of a brokerage account.

Depending on which kind of online brokerage account you have there are different withdrawal rules. Investment income in a taxable brokerage account is, you guessed it, taxed as a capital gain. A retirement account, like an IRA, has a different set of tax and withdrawal rules.

How Much Money Do I Need to Open An Online Brokerage Account?

It depends on which online brokerage you choose. TD Ameritrade for instance doesn’t require any minimum deposit. Others might require a $100 deposit or even several thousand dollars to get started.

How Do I Open An Online Brokerage Account?

For the most part, opening an online brokerage account is a really simple process online and rarely takes more than 15 minutes.

In most states, you’ll need to be 18 to open a brokerage account. Once you’ve gone through the very initial steps of setting up the brokerage account — steps will vary slightly depending on what company you choose — you’ll then need to deposit money into the account or transfer funds. For the most part, though there are some exceptions, this can be done entirely online.

Some online brokerages might require that you verify a transaction to prove your identity. They do that by depositing a small amount — usually a few cents — into your bank account and then you confirm the amount that was deposited. Not all online brokerages will require this, though.

You might be asked if you want to open a cash account or a margin account during setup. We’ll go into the differences below. The other choice you have to make is what kind of brokerage account exactly you want to open — a retirement account or a taxable brokerage account.

What Kind Of Online Brokerage Account Should I Choose?

There are essentially two different types of online brokerages to choose from: online brokers and robo-advisors.

Online brokers are best for people who want to purchase and manage their own investments.

A robo-advisor uses a computer algorithm to choose and manage a person’s investments, based on their risk tolerance, goals, and investing timeline. These online brokerages are best for people who want to be hands-off.

Deciding between the options is pretty complicated. We’ve broken down the best online brokerage accounts to make deciding easy.

Of note, TD Ameritrade falls into the first category, and users will be self-managing their accounts.

Should I Open a Cash Account Or A Margin Account?

Deciding between a cash account or a margin account is kind of like deciding between a debit card and a credit card. A cash account will only let you buy and trade securities based on your account balance. Margin accounts extend you a line of credit to buy securities.

Opening a margin account is a highly risky move for beginner investors and one that comes with a lot of risks.

What Information Will I Need To Open an Online Brokerage Account?

Come prepared with information like your employment, net worth, investable assets, investment goals, as well as your basic information like your driver’s license and Social Security number. You will also likely need to link your bank account to your brokerage account in order to fund the brokerage account.

Open an investment account today with TD Ameritrade, and watch as your investing knowledge takes flight.

Be sure to check out other investing apps in the complete guide to investing apps.